Moyo.Exchange

Bridging the Financial Trust Gap in Sub-Saharan Africa

01 | The Context: Beyond the Numbers

While the World Bank reports a $49.1 billion surge in remittances to Sub-Saharan Africa, the human story is more complex. Immigrants working in the UK and abroad are forced into "informal" channels because existing apps are cumbersome, culturally disconnected, and expensive (averaging 6.4% in fees).

The Challenge: How can we apply Jakob Nielsen’s Design Principles to build a formal remittance tool that feels as trustworthy and intuitive as a conversation with a family member?

Role: Lead Product Designer

Methodology: Double Diamond x Agile Sprints x Design Thinking

Tools: Figma, Miro, Zoom, Otter.ai, Google Forms

02 | Discovery & Strategic Synthesis

The research phase was a methodical exercise in data synthesis. My goal was to move beyond surface-level observations and uncover the root causes of user friction in the remittance market. To ensure no insight was lost and that the process was both collaborative and auditable, I utilized a professional UX tech stack.

The Tools of Discovery

Market Benchmarking (Competitive Audit): I conducted a comparative analysis of traditional giants like Western Union versus fintech disruptors such as LemFi and Wise. My objective was to evaluate their onboarding flows and fee transparency.

The Business Insight: While incumbents have global reach, they lack the regional nuance and user-centricity required to win the trust of the Sub-Saharan African diaspora.

Primary Research (Zoom & Otter.ai): I conducted deep-dive interviews with five frequent remittance users. By utilizing Otter.ai, I generated live transcriptions, which allowed me to remain fully engaged with the participants while ensuring every verbal and emotional nuance was captured for later analysis.

Data Organization & Synthesis (Miro): I migrated all qualitative findings into Miro to build an Empathy Map. This allowed me to categorize raw data into what users Say, Think, Do, and Feel, bridging the gap between raw interview transcripts and actionable design requirements.

Balancing User Desirability with Business Viability

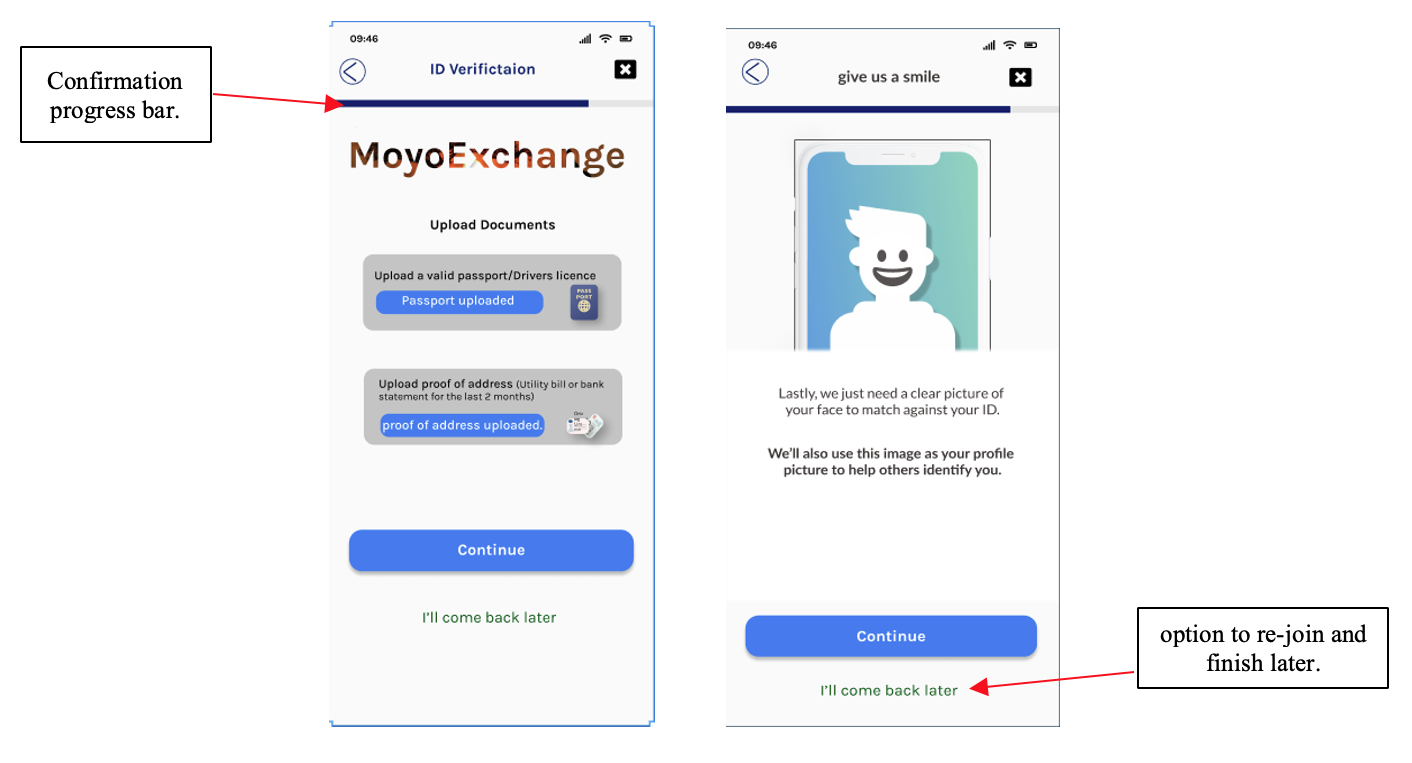

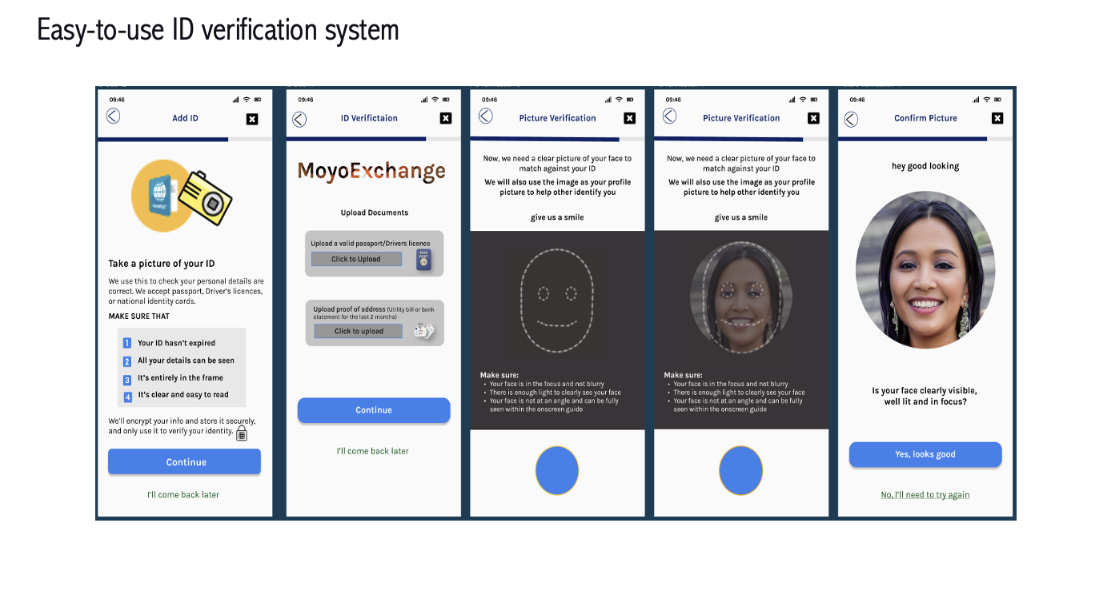

In this stage, a primary strategic conflict emerged: the business requires rigorous KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance, but users find ID verification intrusive and frustrating.

To achieve a "win-win" outcome for both the business and the user, I developed a strategy centered on Trust-Building:

Business Goal: Minimize drop-off rates during the mandatory ID verification stage to ensure a high conversion rate.

User Need: A sense of safety and a clear understanding of why sensitive personal data is required.

The UX Solution: I applied Jacob Nielsen’s Heuristic of "Visibility of System Status" by designing a conversational onboarding flow. This ensures the business meets its legal obligations while the user feels empowered by a transparent, step-by-step progress indicator.

03 | Defining the Human Problem (Personas)

I meticulously crafted two primary personas, a mother-daughter pair to represent the dual ends of the remittance journey.

Mimi

Persona 1: Daughter - London Resident, Mimi.

Persona A: Mimi (The Sender)

Profile: A single mother and auxiliary nurse in London.

Frustration: Her busy schedule doesn't allow for branch visits. She finds current onboarding processes "long-winded" and opaque.

Goal: A secure, 24/7 app that lets her share receipts instantly via WhatsApp.

The Sender (Mimi, London): Needs a 24/7 digital tool that fits a busy nurse's schedule.

Persona B: Mary (The Receiver)

Profile: A grandmother and teacher in rural Nigeria.

Frustration: Traveling to the city to collect cash is dangerous and expensive. She feels apps aren't designed for her local currency needs (Naira).

Goal: To receive funds directly in an account without converting from USD.

The Receiver (Mary, Nigeria): Needs direct-to-wallet alerts to avoid dangerous trips to physical banks.

mary

Persona 2: Mother/Grandmother - Nigeria Resident, Mary.

04 | Balancing Business & User Needs

I facilitated a Design Workshop to ensure the product was viable for the business and desirable for the user.

The "Win-Win" Strategy

Business Goal: High conversion & KYC (ID verification) compliance.

User Need: Transparency and a low "hassle" factor.

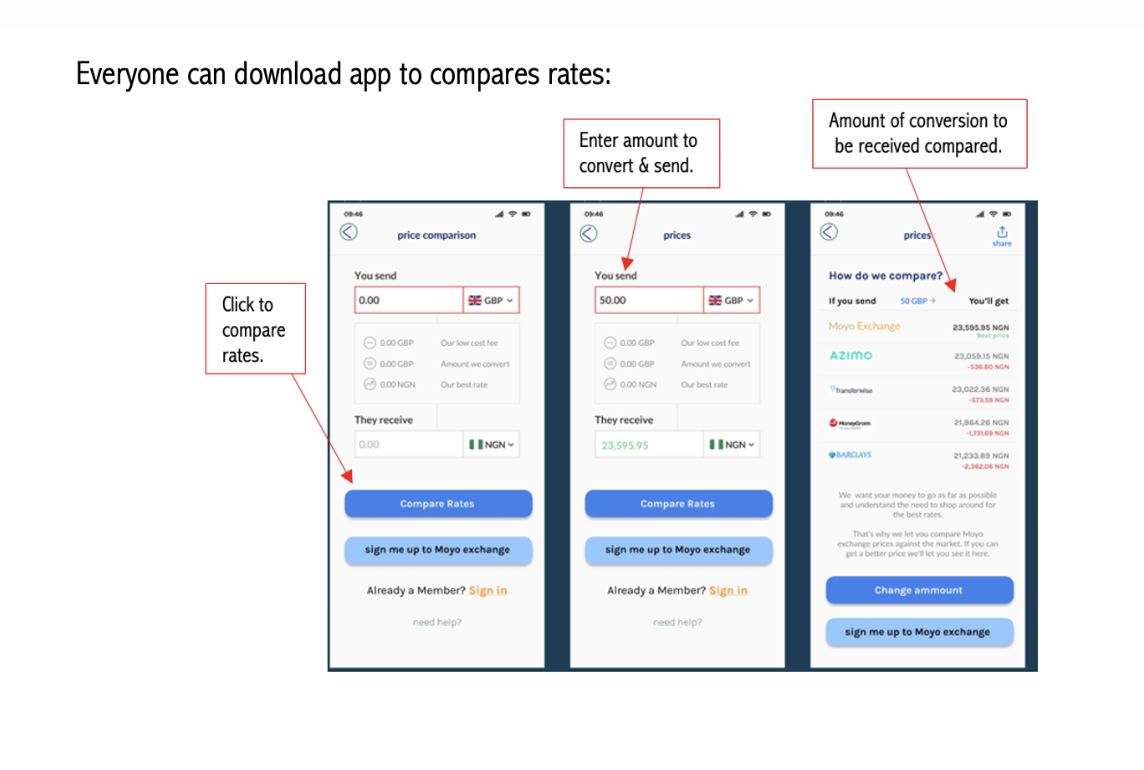

The Solution: I applied Progressive Disclosure. We sell the "Value" (Price Comparison) before asking for the "Work" (ID Verification). This builds trust before the user hits the highest friction point.

design workshop

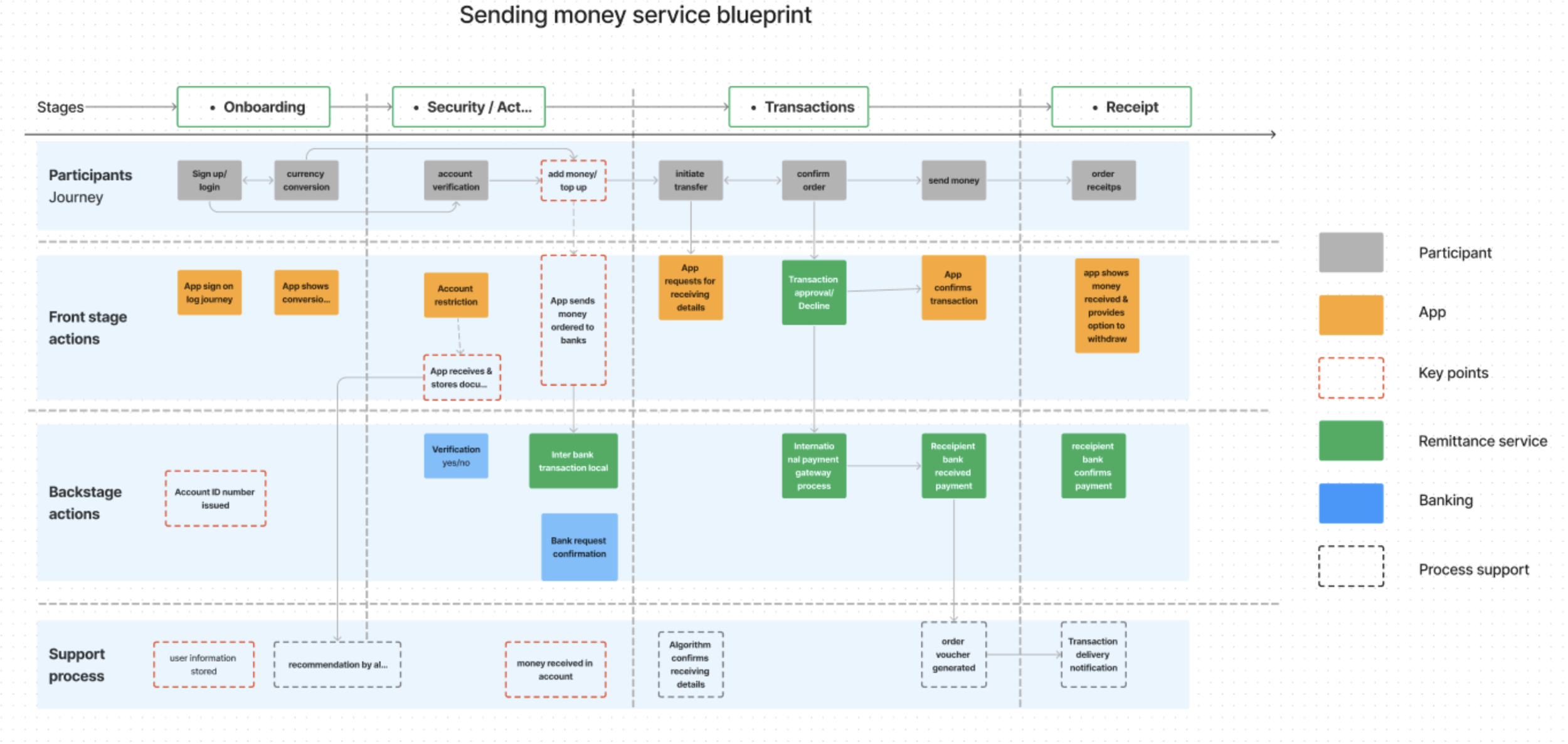

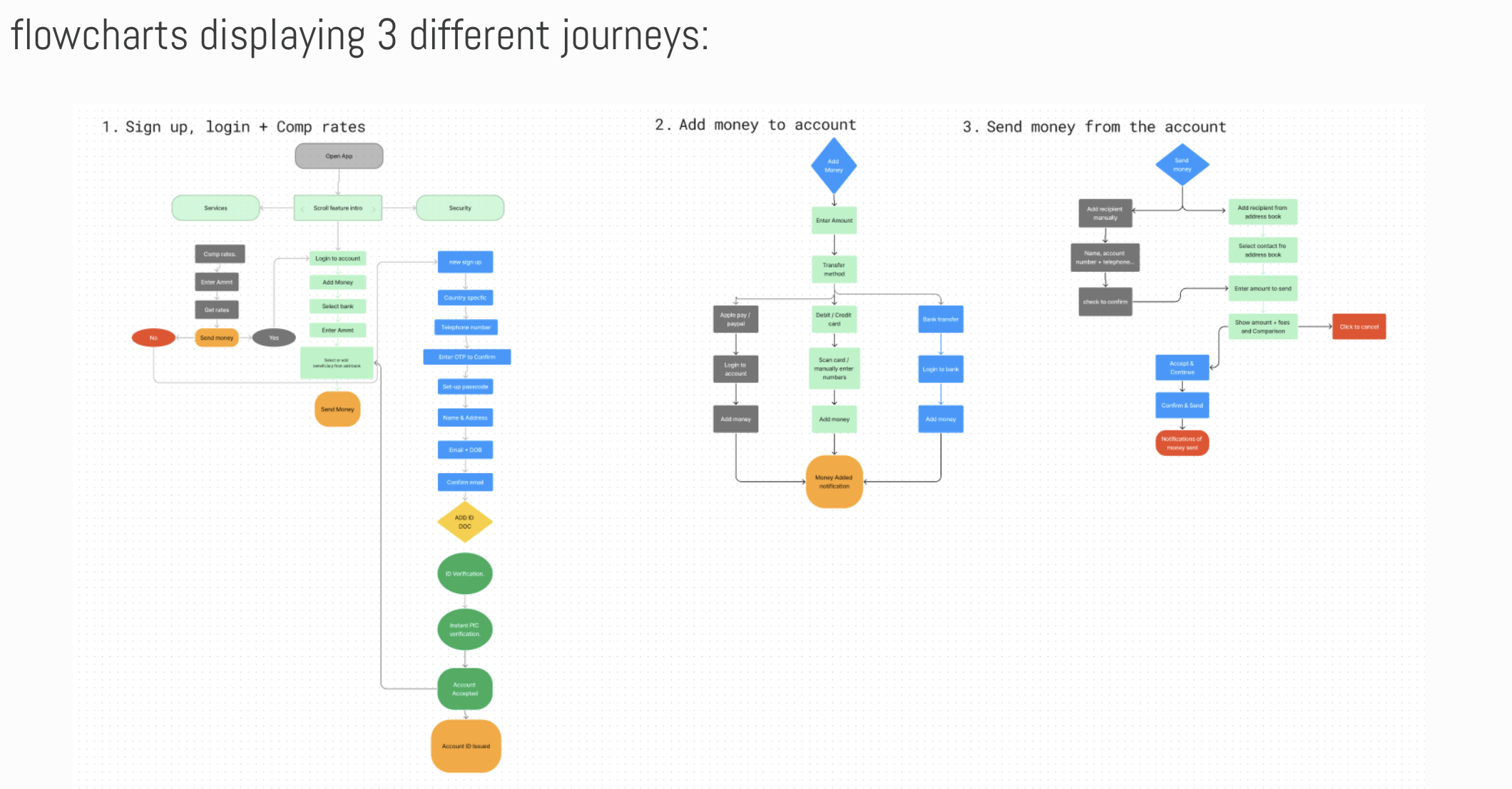

In a collaborative effort, I engaged five stakeholders in design workshops to explore three crucial user journeys:

First-time account sign-up

Depositing funds into the account

Sending money (the primary objective)

This approach allowed for a deep understanding of user experiences, aiming to create clear and engaging onboarding journeys for potential users.

user journey map

By conducting these workshops and taking the personas on an enlightening journey through essential tasks, I gained valuable insights into what might cause pain points to potential users while embarking on any of the 3 different journeys (see user journey map). Additionally, I wanted to gain a clear understanding of the behind-the-scenes processes that would enable the app to offer exceptional services, so we decided on service design blueprint.

05. Ideation & "Fail Fast" Testing

I utilised "How Might We" sessions to turn pain points into features.

HMW allow users to compare rates without signing up?

HMW make complex ID verification (KYC) feel welcoming?

The "Moyo ID" Experiment: I tested three UI variations for displaying the user's digital address.

Result: Placing the ID in the "Thumb Zone" (lower half of the screen) increased sharing efficiency by 52%.

To solve the "Moyo ID" puzzle (the unique digital address), I used the Crazy 8s sketching method in Miro.

The UX Pivot: Testing three concepts revealed that a "Thumb Zone" placement (lower half of the screen) with a clear "Share" label increased user intuitiveness by 52%.

Mental Models: I standardized terminology from "Wallet Number" to "Moyo Exchange ID" to ensure linguistic consistency and reduce cognitive load.

Feedback 1: This was found to be the least intuitive among users, with only 19% of them choosing it as their favourite. One of the reasons for this was that the ID number, located at the top left corner of the card, was not very noticeable on the screen. The "I" icon also failed to convey that the number could be shared without requiring additional investigation.

Feedback 2: This was regarded as the most direct solution by 29% of users. Click on the account ID button; then the wallet ID button appears on the next page which is visible on the screen; however, it doesn't indicate that it can be shared without navigating to the next screen.

Feedback 3: This emerged as the most popular choice during testing, as 52% of users voted it their favourite due to its high intuitiveness. Positioning the ID lower on the card was beneficial as it ensured the information remained prominent and easily accessible within the thumb zone. Furthermore, the iconography with “share” in the text associated with the concept was deemed more suitable for its intended function.

06 | High-Fidelity: From Friction to Flow

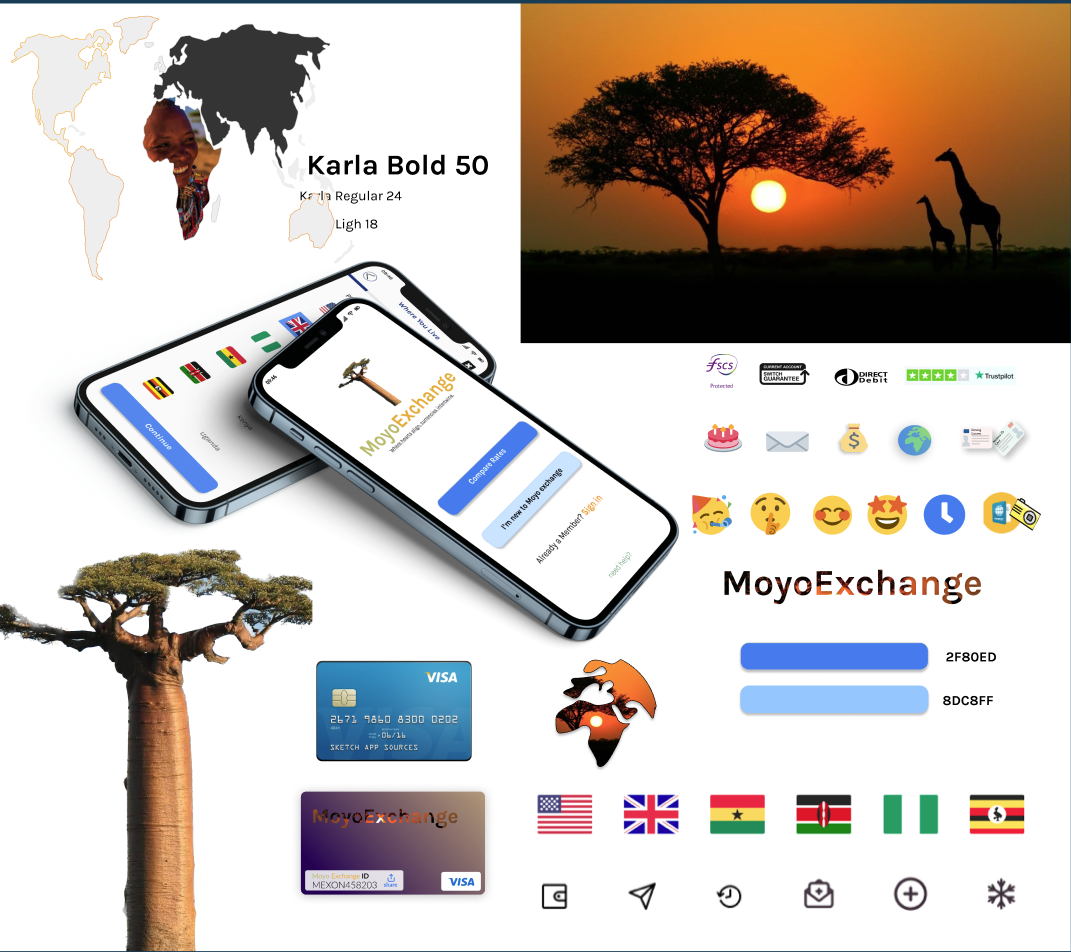

I developed a scalable Design System in Figma, balancing modern minimalism with African cultural identity.

Visual Direction: "Moyo" (I Rejoice) uses white space and regional flag accents for a "local" yet professional feel.

Iteration 1 (Transparency): Moved price comparison to the landing page based on user demand for "Value before Sign-up."

Iteration 2 (KYC): Streamlined ID verification with a Progressive Bar and conversational tone (using supportive emojis) to reduce technical anxiety.

Iteration 3 (Accessibility): Ensured high color contrast and clear typography to meet WCAG 2.1 standards for diverse demographics.

1. Value Before Friction (Sign-up Strategy)

The Insight: Users were hesitant to sign up before seeing real value.

The Iteration: I moved the Price Comparison Tool to the landing page. Users can now check rates in 3 quick steps before creating an account.

Business Win: Increased "Buy-in" and trust, reducing early-funnel drop-offs.

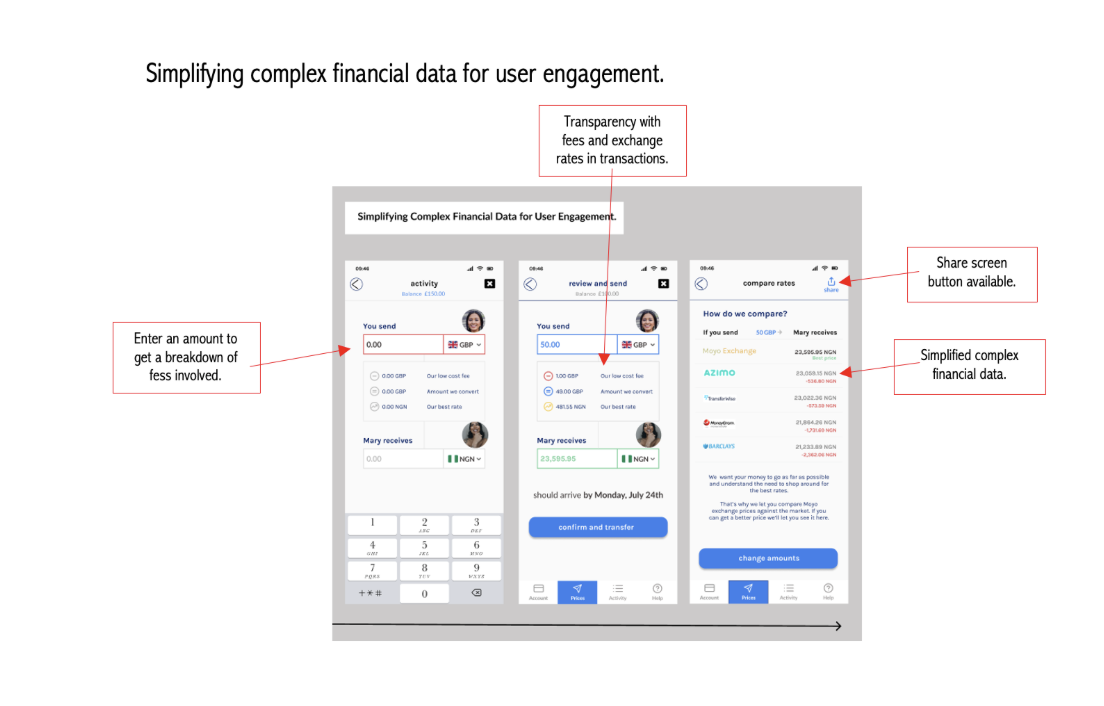

2. Simplifying Financial Complexity

The Insight: Complex fee structures and exchange rates caused cognitive overload.

The Iteration: Redesigned financial data into clear, actionable formats. I emphasized transparency so users can share transaction details with family instantly—no sign-up required for the receiver.

User Win: Empowerment through financial education and clarity.

3. Effortless ID Verification (KYC)

The Insight: Identity verification felt like a "hurdle" that triggered anxiety.

The Iteration: Streamlined the ID upload and live-photo process to be frictionless. I replaced technical jargon with clear, supportive instructions.

Business Win: Meets strict legal compliance without sacrificing user conversion.

4. Conversational Tone & Trust

The Insight: A cold, corporate tone made users wary of sharing sensitive data.

The Iteration: Adopted a friendly, conversational tone using supportive emojis and approachable language (backed by UX Collective studies on emoji usage).

Balance: I balanced this "warmth" with high-security cues (passcodes and progress animations) to ensure users felt both welcome and safe.

07 | Validation & Core Journeys

Usability testing (5 participants, NNG Principles) resulted in a 100% Task Completion Rate.

Onboarding: Secure, compliant, and feels like a conversation.

Funding: Multi-channel options (Apple Pay, Card, Bank Transfer).

Transfers: Smart-syncing contacts with verified photos to eliminate "sender anxiety."

Growth: Seamless referral loops and instant social proof (receipt sharing).

The visual language, "Moyo" (meaning "I Rejoice"), blends modern minimalism with African cultural identity.

Strategic Minimalism: High contrast and generous white space for clarity.

Regional Logic: Adapting flows for UK-based Visa users vs. Africa-based Verve/Mobile Money users.

08 | Visual Identity & Design System

The Pivot: Balancing Heritage with Usability

The initial design featured vibrant African patterns and bold colors. However, testing showed these were distracting for a financial app. I refined the aesthetic to align with ISO 9241 standards, utilizing:

Generous White Space: To reduce cognitive load during sensitive transactions.

Subtle Cultural Cues: A refined palette inspired by regional flags to maintain a "local" feel without sacrificing clarity.

Meaningful Branding: The name "Moyo" (Yoruba for "I Rejoice") was chosen to evoke the joy of communal support.

09 | The Core User Journeys

1. Human-Centered Onboarding (Sign-Up)

Creating an account is the highest-friction point due to mandatory ID verification.

The Strategy: I broken down the process into bite-sized steps, using real-time feedback and a welcoming tone of voice to motivate users through the identity and live-photo checks.

The Result: A secure, compliant process that feels like a conversation, not an interrogation.

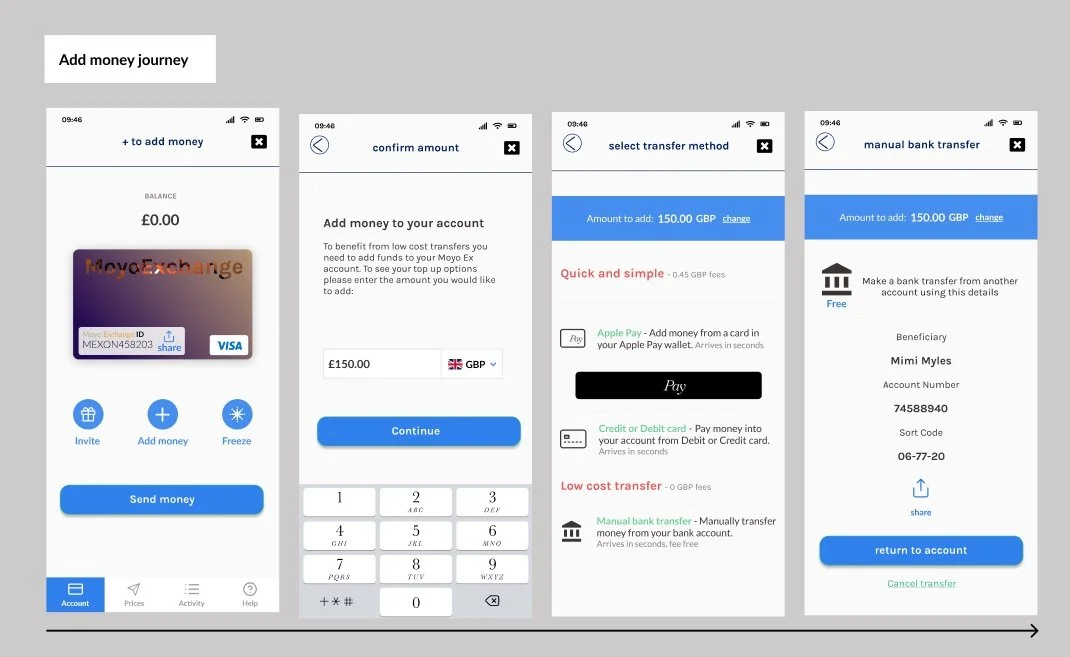

2. Frictionless Funding (Add Money)

To maximize accessibility, I designed a multi-channel funding interface.

Flexibility: Users can choose between Apple Pay, Debit/Credit cards, or fee-free Bank Transfers.

Consistency: By standardizing the "Moyo Exchange ID" label, I built a reliable mental model that helps users understand exactly how their digital wallet is identified.

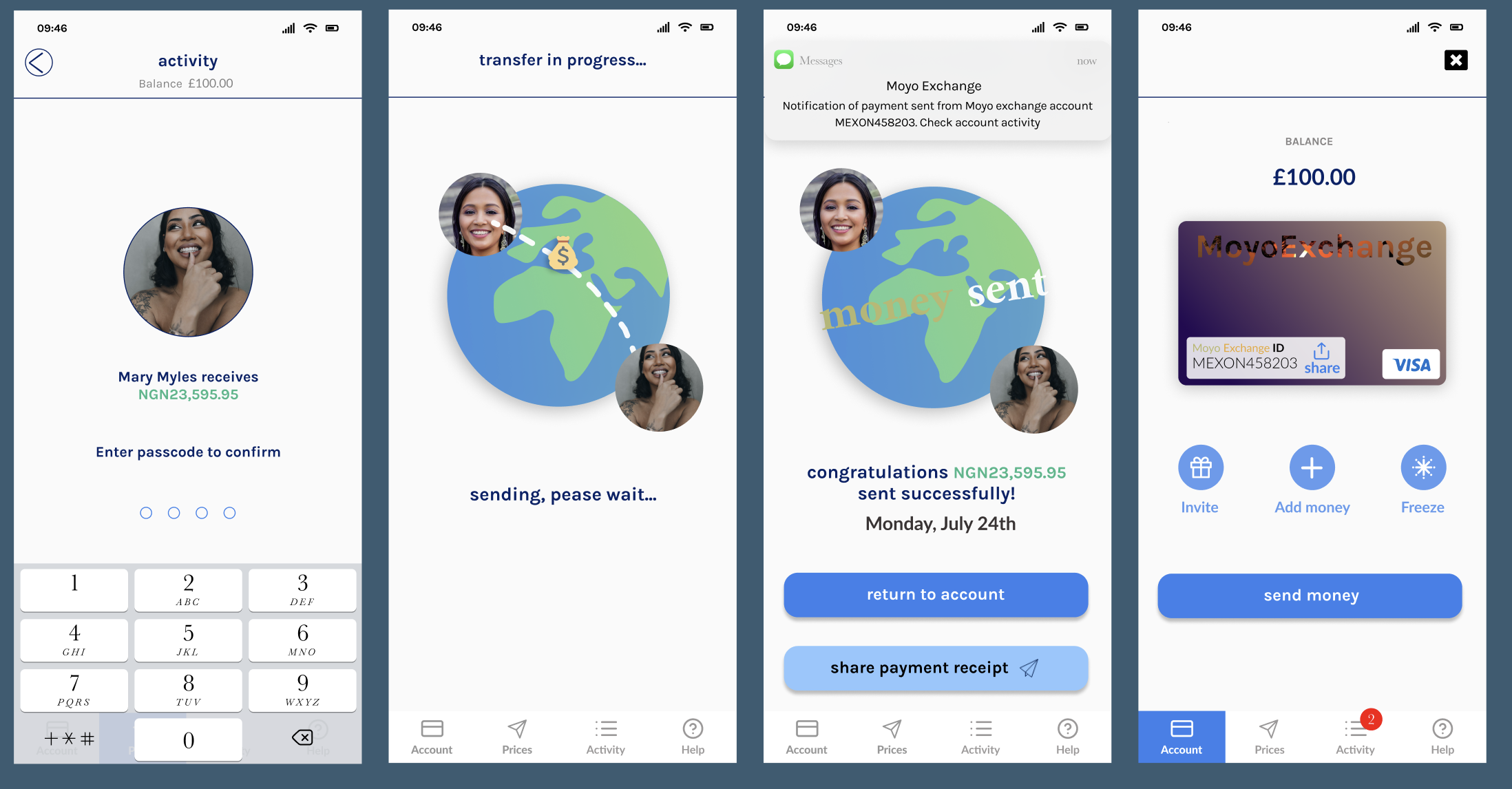

3. Peer-to-Peer Transfers (Send Money)

The transfer journey was designed to eliminate "sender anxiety."

Smart Syncing: The app automatically identifies existing Moyo users in the contact list, using verified profile photos to prevent errors.

Security & Feedback: Transfers are secured with passcodes, while real-time animations and SMS confirmations provide immediate peace of mind.

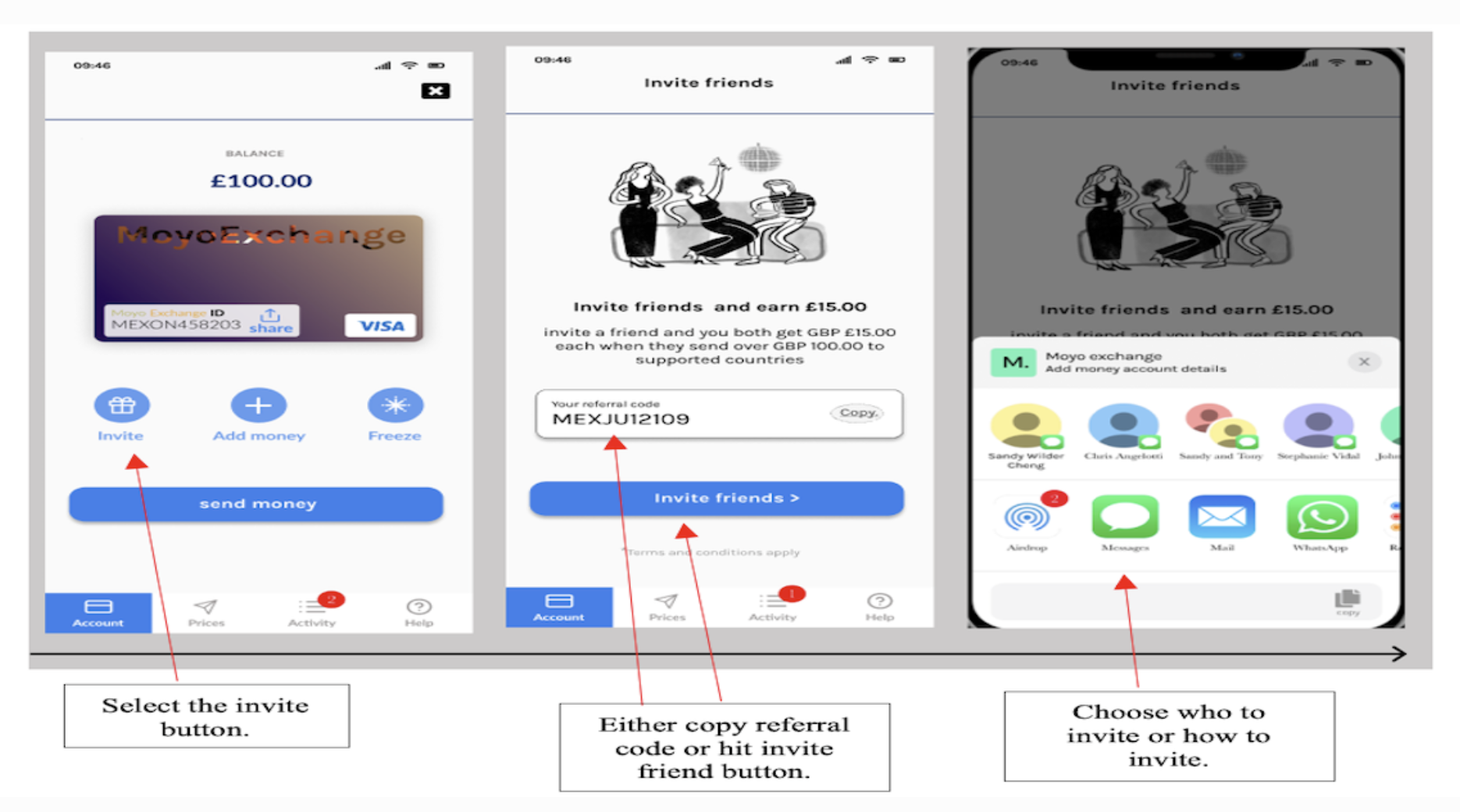

4. Community Growth (Referrals & Sharing)

To support business growth and user rewards, I designed a seamless referral loop.

Incentives: Clear CTAs for users to invite family and earn commissions.

Social Proof: Easy receipt sharing ensures the receiver is informed instantly, closing the loop of trust.

10 | Reflections & Future Roadmap

Project Retrospective

In eight weeks, I transitioned from an identified market gap to a high-fidelity MVP that directly addresses the pain points of users like Mimi and Mary. By facilitating target-driven workshops and managing agile sprints, I delivered a solution that is not only user-centered but also business-ready.

Key Learnings:

Fintech Literacy: I gained a deep understanding of the regulatory landscape and the rigorous security protocols required for successful KYC (Know Your Customer) onboarding.

Cultural Nuance vs. Standard UI: I learned that while cultural connection is vital, it must never compromise the functional clarity of a financial tool.

Process Efficiency: Successful delivery relied on setting clear expectations and using the Double Diamond framework to maintain project focus under tight timelines.

The Road Ahead

To further elevate the Moyo Exchange ecosystem, I have identified the following strategic next steps for the beta release:

The "Receiver" Experience: Designing a dedicated onboarding flow specifically for first-time fund recipients in Sub-Saharan Africa.

Security & Safeguarding: Implementing "Guardian Accounts"—a feature allowing a trusted relative to freeze services in the event of suspicious activity or emergency.

Regional Integration: Developing the UI for linking regional bank cards (like Verve) to monitor local transaction activity directly in-app.

Alternative Funding: Exploring the integration of stablecoins and cryptocurrency, aligning with the rapid adoption of digital assets across the African continent.

Conclusion

Can a remittance app designed specifically for the Sub-Saharan African diaspora move users from informal channels to formal ones? By prioritizing Transparency, Cultural Familiarity, and Jakob Nielsen’s Heuristics, Moyo Exchange proves that it is possible.

The resulting design addresses the historical "lack of comprehension" in the industry, offering a seamless, secure, and joyful experience that turns a complex financial chore into a moment of connection.